Stocks are up for a seventh day and the pundits at CNBC and elsewhere think they will keep rising, but here’s a burning question.

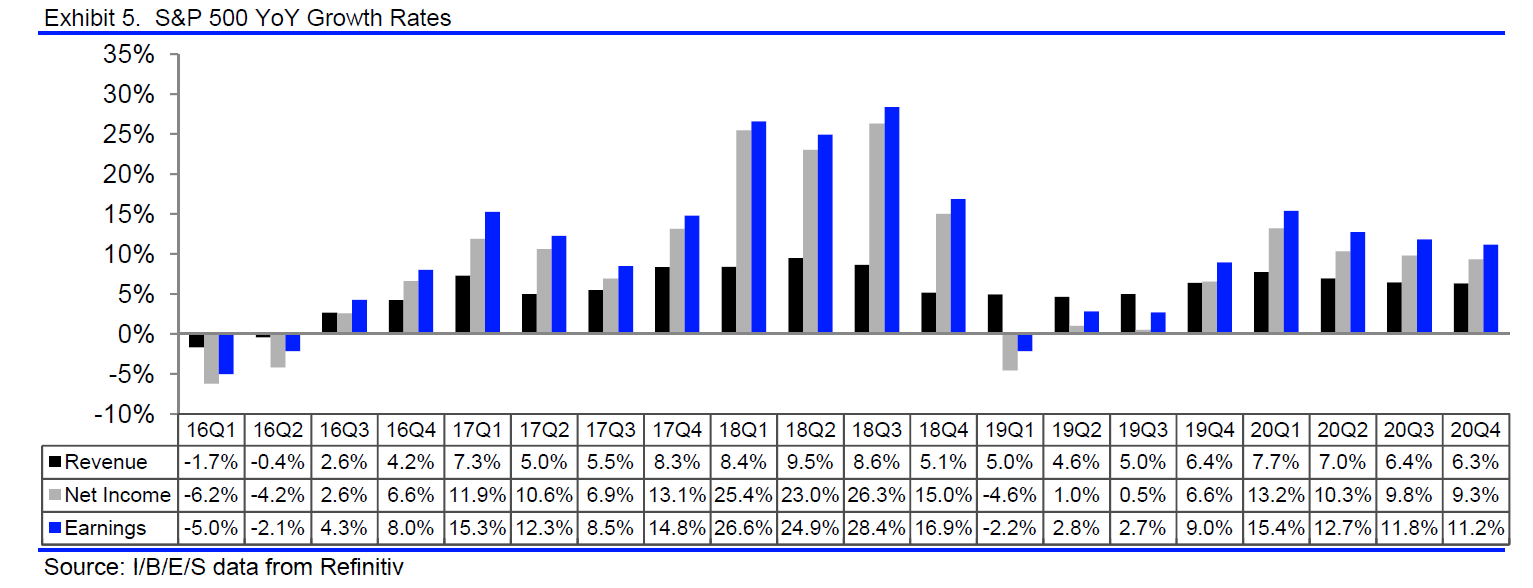

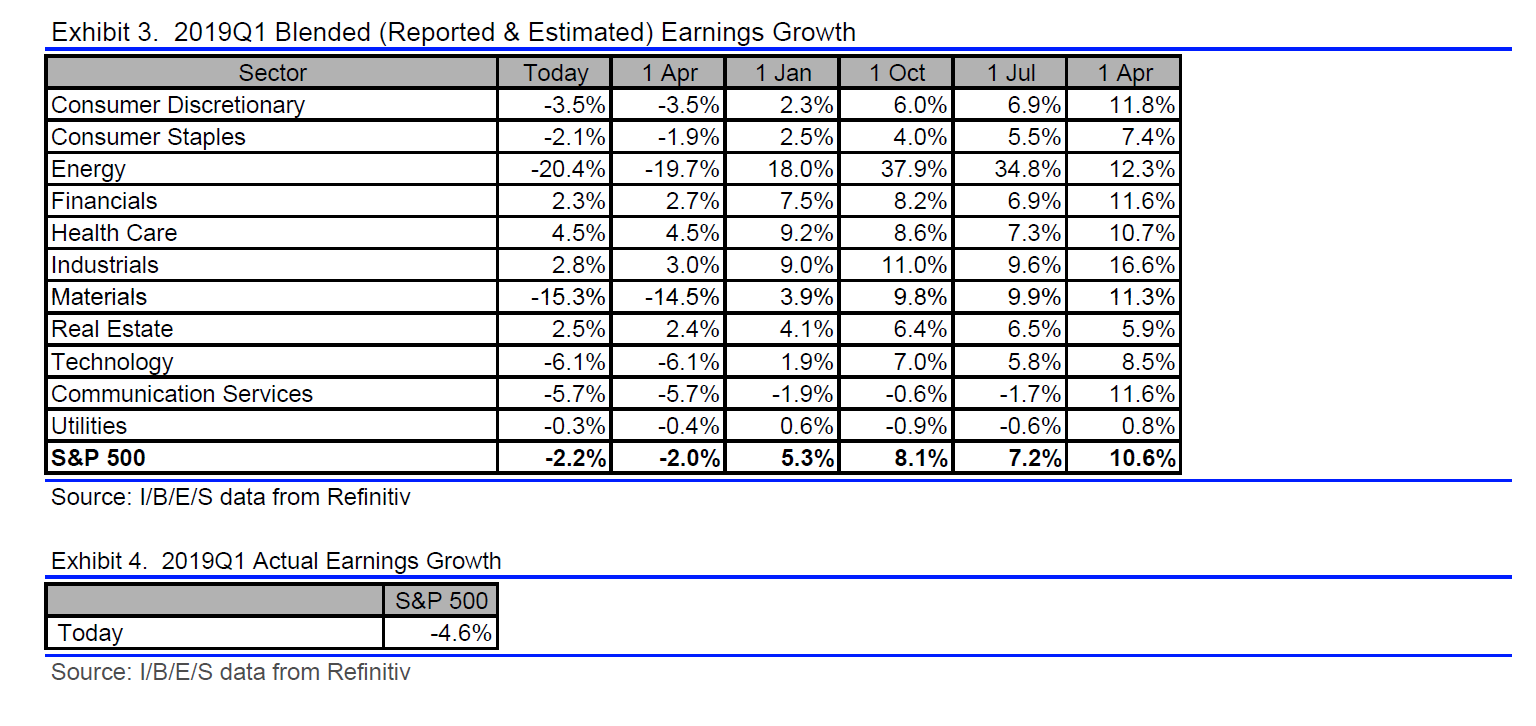

Why should stocks keep rising if their ultimate driver, earnings, are falling? That’s the expectation for Q1 and as the chart shows, earnings growth expectations have been dwindling consistently in past six months.

One reason is lower interest rates, though today’s good economic numbers don’t really support the case for a cut (whatever the President says).

If earnings ease and rate cuts don’t materialize, it will be hard for the run in stocks to continue. Or will it?

What is clear is that with the 2020 presidential election campaign warming up (easy to forget it is not until November next year), the current administration is eager to keep the economy and markets humming, whatever it takes.

The good news for investors is that after weak Q1 earnings growth, admittedly a function of outsized gains last year due to tax reform, growth should resume in the following quarters (see chart below).

Or at least that is what is in the forecasts, notwithstanding the likelihood they will be revised as time goes by.