The big debate in financial markets this week is whether Wednesday’s concerning April inflation data amount to a problem for the Federal Reserve’s easy money agenda or a blip that can be safely ignored.

A standard line in economics that one should get too worked up about one data point. But that’s exactly what happened this week when the S&P 500 fell 2.1% (before rebounding later in the week) and 10-year US Treasury bond yields spiked to around 1.70% (below).

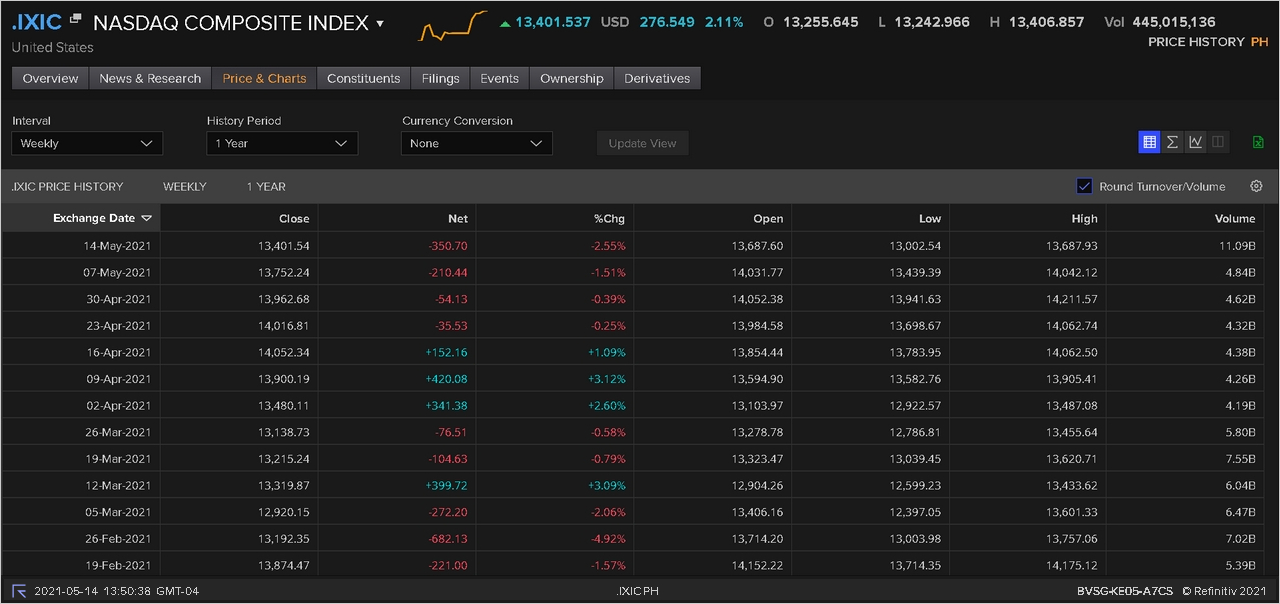

Inflation fears had a more pronounced effect on the tech-heavy Nasdaq Composite Index, which as of Friday afternoon (a few hours before the close) was on track for its fourth straight week of losses.

Tech stocks have been cruising for a bruising for a while, the unknown being how much of a pullback is sufficient before the better names are worth buying.

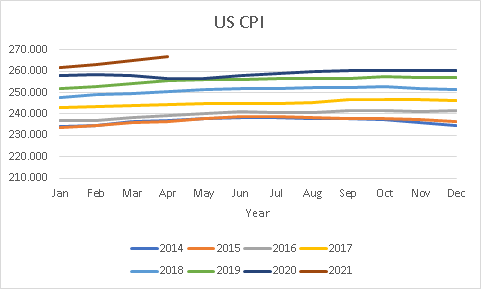

We won’t go there today but one way of looking at the inflation question is to ask whether it is just the reversal of some deflationary trends with the onset of Covid-19 last year. If so, this would support the case that accelerating inflation is not likely to be permanent.

While inflation is running hot right now (driven by supply shortages in certain products), there was some deflation this time last year, exaggerating the extent of the move. Admittedly the headline data (+0.8% for all items) is measured versus March, not April 2020, but there is still a good argument to be made that the price rises reflect some pent-up demand for goods and services.

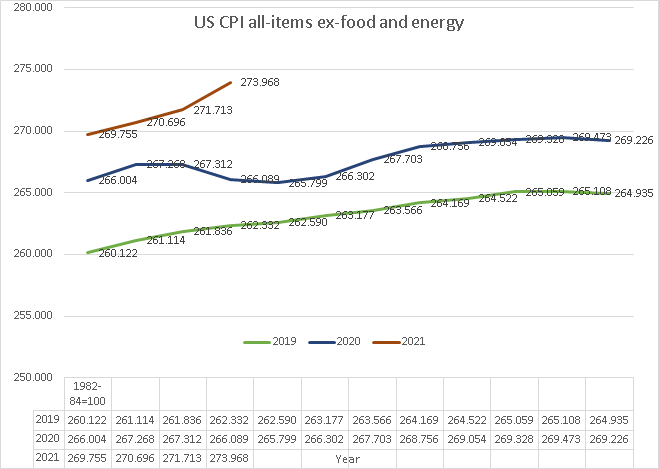

If strip out food and energy (see chart below), you can also see that the latest number also follows a weak print the same time last year.

There’s also a lot of mixed signals and several classic signs of a inflation breakout are missing, including any big move up in wages.

This is one of the reasons the Fed is not panicking just yet and this data may support the case that at least part of the April bounce in CPI was transitory.