Uber or Lyft? Which to use is a question that has dogged New York’s ride-sharers for years.

With both poised to go public in the next month or two, the battle between these two bitter arch-rivals is about to extend to winning over the hearts and minds of the investment community. Things could get really interesting.

On Friday (March 1), Lyft started the clock for its IPO by filing publicly. It registered confidentially with the SEC on December 6, so it is already well advanced through the SEC review process. From all reports, the IPO roadshow will begin March 18 (it has to be at least 15 days after the public filing). With a standard roadshow, the deal should price on either March 27 or 28 before the stock debuts on Nasdaq the following day.

Cue plenty of (valid) commentary about the company’s cash burn and lack of profitability.

Multiply the media frenzy by four (?) once Uber files, which could well be in the next few weeks because (probably not coincidentally) it filed confidentially on the same day as Lyft.

Since it is more complex, larger and a more global beast, and the SEC is going to look really bad if it doesn’t work, Uber’s filing is said to be getting more scrutiny from the securities watchdog.

There is no doubt that ride-sharing is a social phenomenon that promises to revolutionalize and is disrupting transportation, and, depending on your perspective, for better or worse. Less clear is whether the numbers stack up.

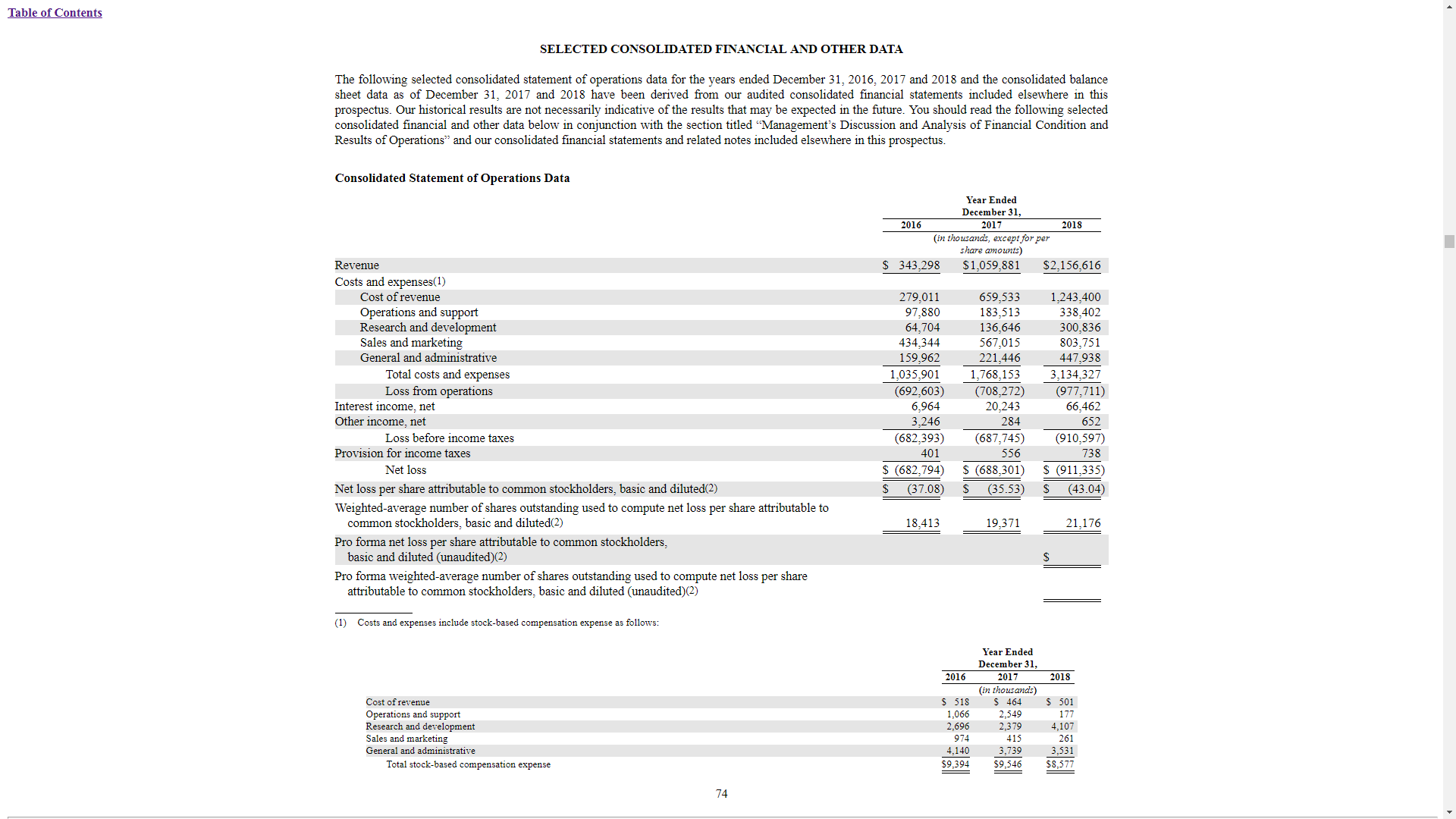

Lyft lost $911m last year (net loss but adjusted Ebitda is a similar amount) and burned through $281m of cash (based on its negative operating cashflows).

This is bracing stuff compared with the average IPO, but Lyft also doubled sales last year. Getting to even greater scale as quickly as possible, and outlasting other upstart competitors, is the priority.

I’ve seen IPOs that were growing that fast AND were very profitable at the time of IPO, but, counterintuitively, this can be a sign a company’s best days are behind it. The 2015 IPO of fitness band maker Fitbit is a good example. It presented some of the best financials ever seen for an IPO, but the deal came at or near the peak of its growth just as a host of competitors were able to come into the market with significantly cheaper products.

Though the IPO went well and the stock traded up initially, the deal didn’t stand the test of time. Fitbit stock now changes hands at just 30% of its IPO price.

More important for new investors is what Lyft’s financials will look like after this year and the coming years.

I thought the most interesting part about the filing (apart from the actual finances and the litany of legal actions the company faces) was the final part of the letter to investors from the co-founders Logan Green and John Zimmer.

“If we told you we were building the world’s best canal, railroad or highway infrastructure, you’d understand that this would take time. In that same light, the opportunity ahead requires continued long-term thinking, focus and execution. In order to best deliver long-term value, we will drive the business forward with three key principles:

| “1. | We first serve drivers and riders. |

| “2. | We prioritize the long-term health of the business, over day-to-day reactions of the markets. |

| “3. | We thoughtfully balance investments in growth and profitability considerations, while deliberately leaning more towards growth (especially in these early days).” |

Maybe it is just me but that doesn’t read like a company that is going to swing into profits anytime soon.

The question is: Does it matter? Much like Amazon, as long as the company continues to grow at above-market rates, it will be able to access capital and fund its growth without generating positive cashflow/Ebitda/profits etc.

That growth is the same reason why investors will swarm this IPO, the caveat being we don’t know the valuation.

At the mooted valuation of up to $25bn, Lyft would be coming at 12x 2018 sales or thereabouts (actually less using an EV/sales multiple that subtracts cash and equivalents from market cap used in the numerator)

The multiple comes down quickly if the company can continue something close to the current rate of growth, a doubling of its net revenues last year to $2.16bn.

It is a sure bet that market models will factor in high-growth for the next few years (50%-plus) at least.

Given there are not many growth stories like this around, this alone should ensure the IPO is heavily oversubscribed and (maybe) opens strong.

But whether these forecasts are right are a completely different thing.

Further out, things could be challenging, the fear being this could be more of a Blue Apron than Amazon-type situation. Blue Apron also had growth but huge cash burn in a new market (meal-kits) where the number of competitors offering introductory discounts multiplied quickly.

Lyft is actually the first-mover in ride-sharing but is dwarfed by Uber and there are quite a few other competitors too (Juno and Via in the US for starters).

So far ride-sharing is not like search (Alphabet/Google) and social media (Facebook) that have pretty much been winner-take-all markets, and not necessarily for the first-mover (Yahoo, MySpace).

But it could be, which is why Uber and Lyft are going public at the same time in a race to tap out equity capital providers first.

Talking to a number of NYC drivers in the past few days, it seemed they were all either using Uber exclusively or using both, but not Lyft exclusively.

According to one, using Lyft alone was not enough to make a living, which just highlights how Uber has the upper hand in markets like NYC and probably elsewhere too.

So even though Lyft has more room to grow by virtue of its smaller size, those that doubt the industry’s economics will sustain multiple players are going to back Uber instead.