Reading this weekend’s edition of Barron’s, I was reminded about a stock I have long thought worth buying but never felt any urgency to do so.

I am talking about General Motors (GM). Yes, I know what you are thinking: Forget about it.

Shortly after I arrived in the US just before the financial crisis, I happened to listen to one of the automaker’s quarterly earnings calls.

I remember thinking I had never seen (or heard of) a company with as many problems as GM had at that time. They included too much debt, huge pension and healthcare liabilities, product recalls, poor corporate governance, and, more subjectively, an inferior product to most of its competition.

Yet the overhaul of the company alongside its 2009 pre-packaged bankruptcy and November 2010 re-IPO was supposed to plant the seeds for a new GM that would return to the top of the American corporate heap.

Well, the company shed a lot of debt and liabilities and got new management, but turns out it was still not much of an investment.

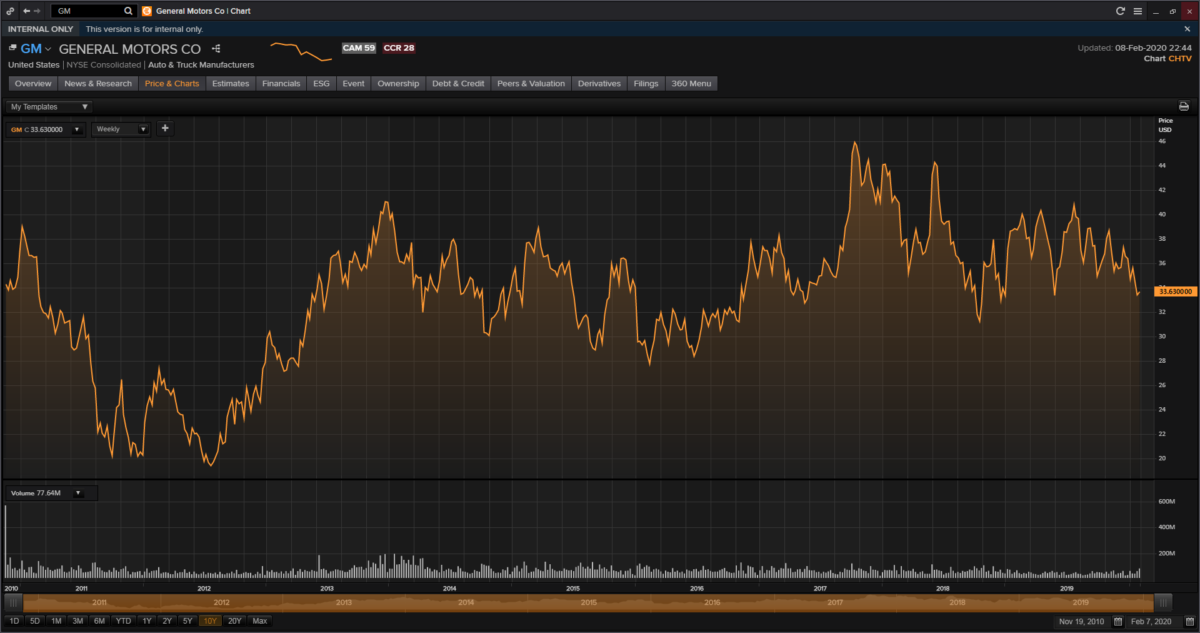

Consider the IPO priced at $33.00. Roll forward to today and the stock is trading at just $33.63. Talk about a lost decade.

Here’s the chart:

Source: Refinitiv/Eikon

When I looked at the stock about a year ago, it was trading above $40 a share and I felt I’d probably missed an opportunity to get this one really cheaply. Having been burned on a few turnarounds that never happened (not mentioning any names), I wasn’t about to chase it.

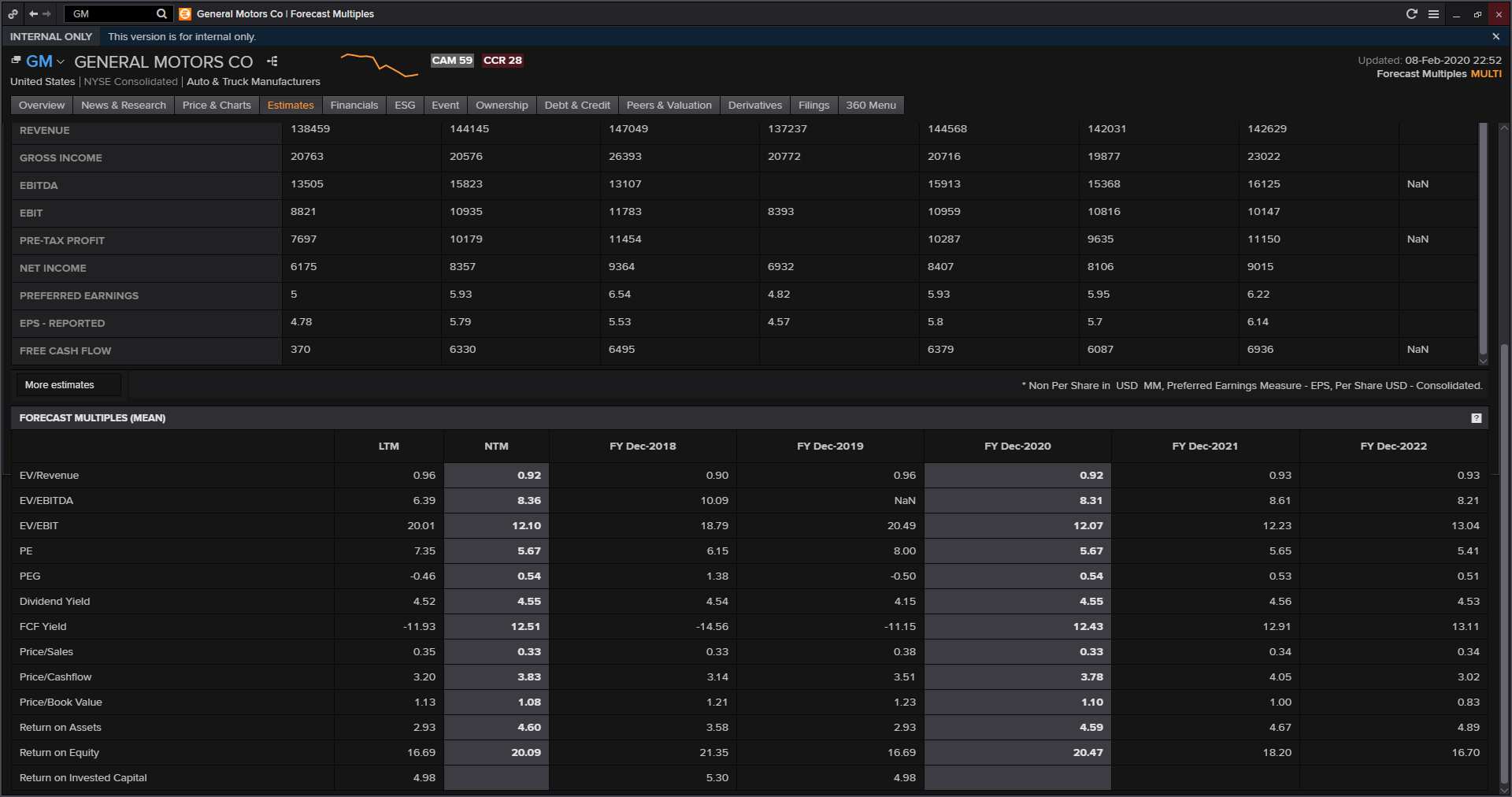

But with all the attention on Tesla and investors thinking this is late in the cycle for auto sales (ICE cars at least), GM shares now wallow at a mid-single digit forward PE, just 5.7x 2020 estimates based on the numbers below.

The lack of enthusiasm for the stock partly reflects the company’s flat 2020 adjusted EPS forecast of $5.75-$6.25 a a share unveiled just this past week, somewhat undermining its investor day pitch that its stock is undervalued.

GM reported adjusted EPS of $4.82 last year, but this was depressed by work stoppages in the second half. The forecast is actually below GM’s 2018 adjusted EPS of $6.54.

CEO Mary Barra was asked by clearly frustrated analysts (none have a sell recommendation) what she is doing to get the stock price moving up and whether GM should bite the bullet and merge with a rival.

Here’s what she said.

| “We are always exploring opportunities that are going to create long-term shareholder value. We’re not interested in doing something that (creates) just a short-term pop, but – and we consider all alliances…We’re in an era right now where a lot of people are talking to a lot of people. People don’t understand how significant the work that we’re doing with Honda is when you think about fuel cells, when you think about AV and when you think about effectively EV cells. For those of you who have had a chance to see or look online for the Cruise Origin, the three teams work together rather seamlessly. And in order for groups to work together, it’s got to be at the engineering level, and we’re demonstrating that and we have been. But again, we’ll consider all those opportunities. “I think to get to your core question, we do feel General Motors is a compelling investment opportunity. We feel, across many of our strong franchises, you mentioned trucks, we’ve talked about OnStar, we talked about mid-crossovers, (and) we do believe China is going to be very important in the future. It still is a market that has tremendous growth potential. The scale that we get allows us to compete in a way, from an electrification perspective, across a full range of products from value brands to luxury brands. “So I will tell you, there’s nothing that’s off the table that we don’t think is going to create long-term value. And we’re going to aggressively go at what we’re working on – improving the business…especially the small and the compact crossover segments. The global family of vehicles has been very important around the globe for doing that. “But there’s the work we’re doing on the core we feel very good about, and we feel we’re getting to the final chapters in that. But then also our conviction around EV, our conviction around AV, we think it sets up General Motors to be uniquely positioned to participate strongly in the future of mobility.” |

This very accident-prone stock could sure use a near-term catalyst, but, I don’t know, it doesn’t sound like Barra has something up her sleeve.

The positive is that it probably can’t get much worse for GM.

The company is expecting a significant increase in what it calls adjusted automotive free cash flow this year ($6bn-$7.5bn versus just $1.1bn last year) and once that begins to become more apparent in the numbers investors might give the company a bit more credit.

GM is now committed to what it calls an “all-electric future” and with Tesla shares running hard, there will be a point at which GM’s EVs will get a closer look from consumers and, hopefully, investors.

Particularly if there is a swing away from momentum stocks at some point this year (in that event, there’s certainly going to be less downside).

On valuation grounds alone, GM, and Ford for that matter (it similarly trades at single-digit multiples), look worthy of further investigation.