A lot of people are talking about the outsized influence that Cathie Wood’s Ark Investment Management has on technology investing.

Though I am not one to buy into the hype (particularly for things like bitcoin), there’s something to be said about focusing solely on disruptive technology investments at a time when there is no lack of capital around to fund big ideas.

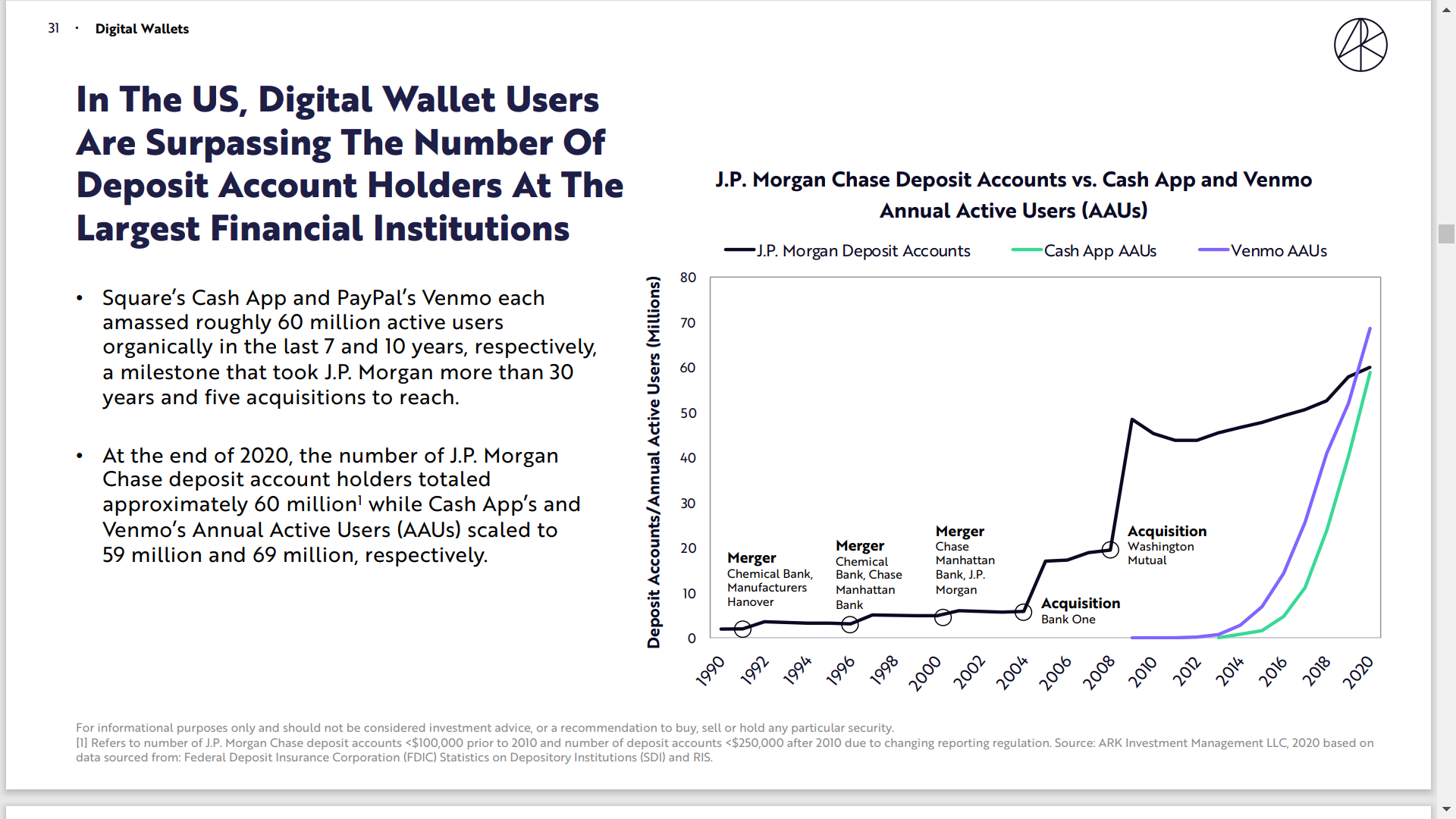

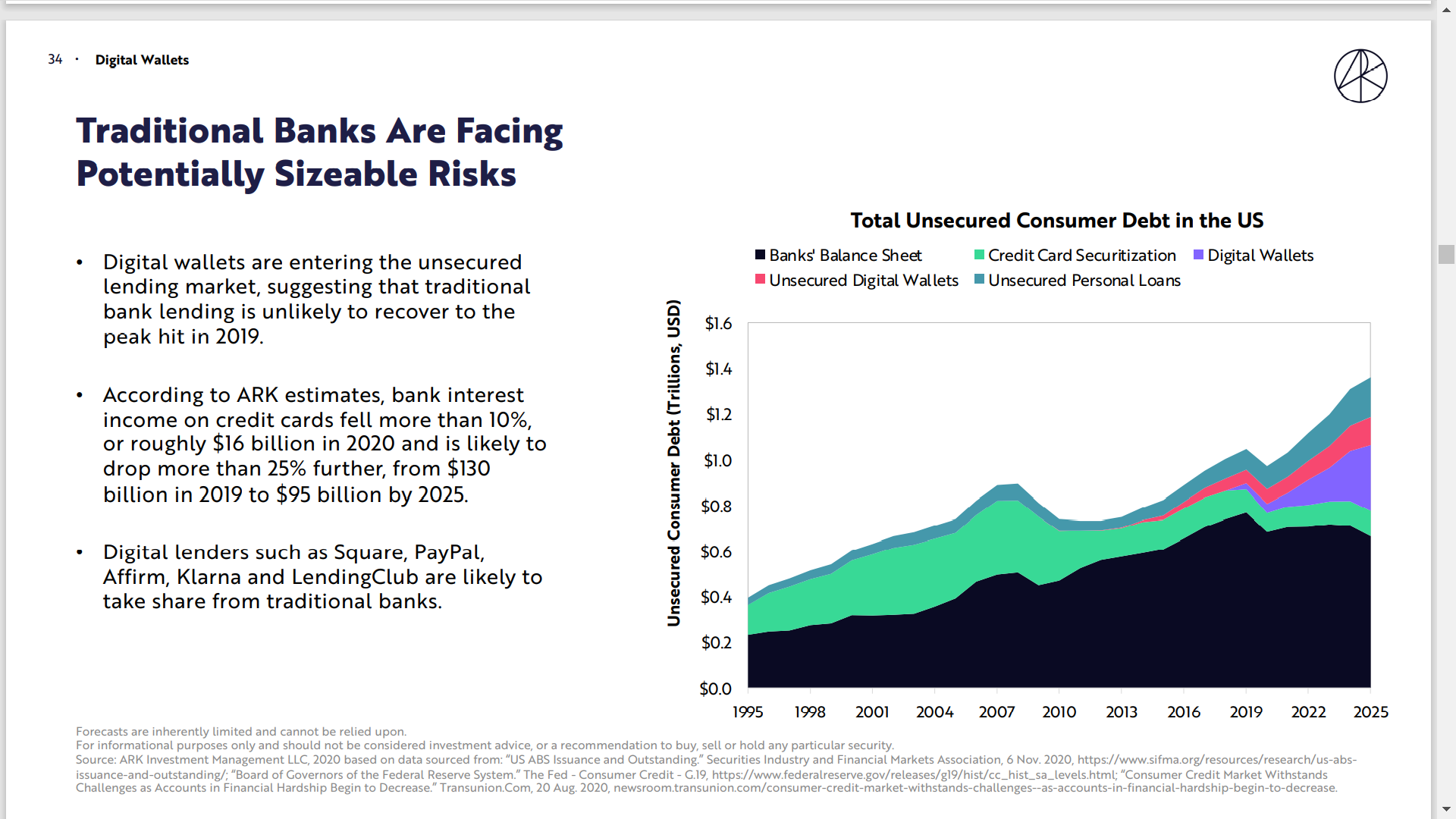

This recent report from Ark Invest on their “Big Ideas” is definitely worth a look. There’s a lot here, but to start with here’s some charts that caught my eye on the issue of fintechs eating the banks’ lunch.

Something is going to have to give re banks and their credit card businesses. It’s getting harder to justify charging such high rates in a low interest rate/easy money environment and they will need to do more to show consumers the value of rewards programs.

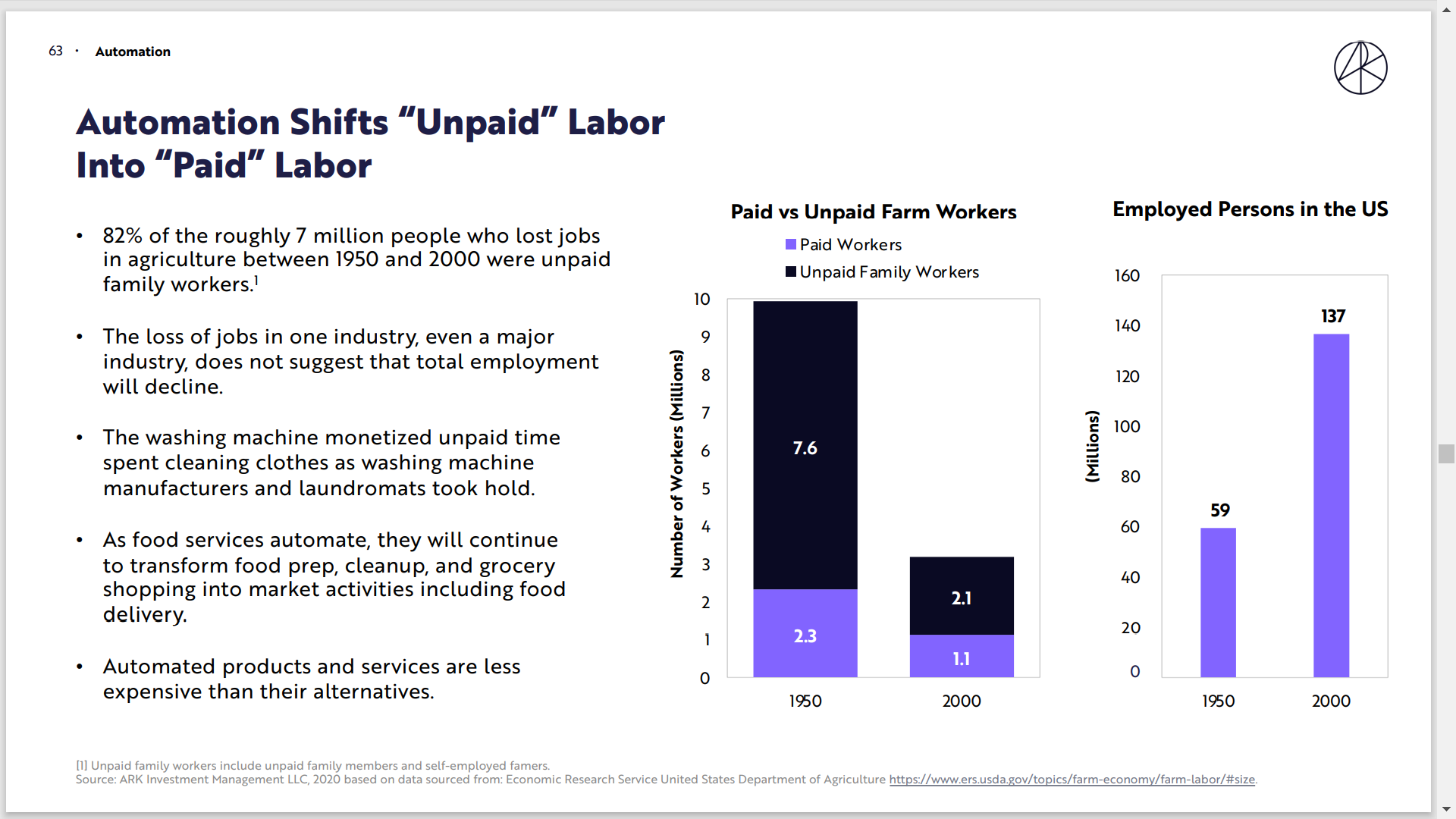

And one on automation and the counterintuitive impact on the labor market:

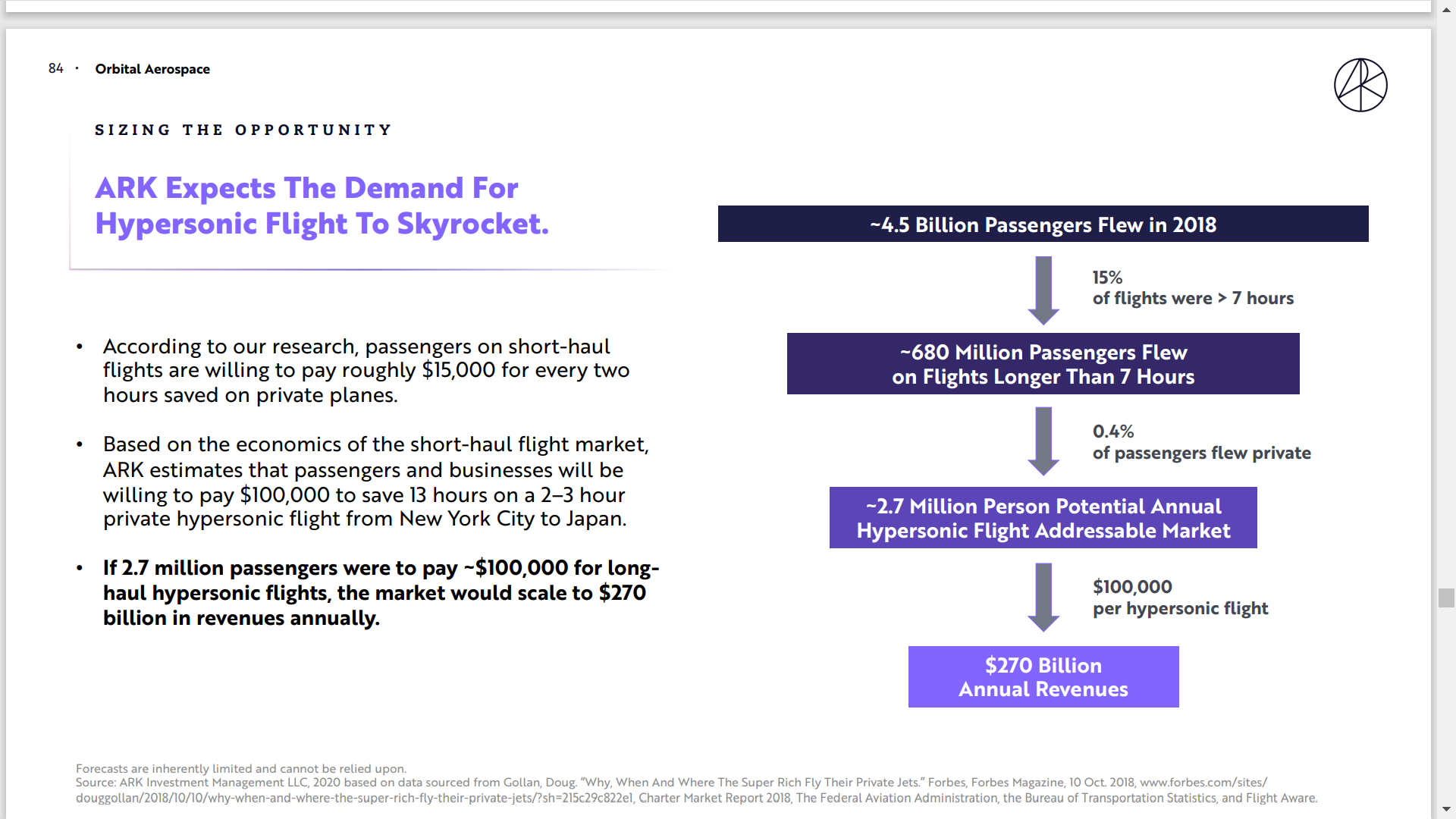

And hypersonic flight! (though I don’t think people will really be paying that much for a flight once it scales)…