Quit worrying about Amazon’s PE, earnings

As long as it keeps growing, does it really matter?

Shares of e-commerce giant Amazon fell 5.4% to $1,626.23 today in the aftermath of Thursday’s Q4 earnings release.

The release showed Amazon’s net sales rose 20% to $72.4bn, while net income was $3bn or $6.04 a share. These numbers beat Street estimates (slightly) but Amazon’s Q1 estimate was a little light.

Amazon told investors it expects Q1 2019 sales of $56bn-$60bn, 10%-18% above the $51bn number it reported in Q1 2018.

The stock reaction proved an open invitation for critics to recycle their usual complaint about this stock – its sky-high price/earnings ratio (80 on a trailing 12-month basis) and its lack of earnings versus relatively low PE companies like Apple.

As someone who naturally sympathizes with value investors, I am not here to argue that Amazon is a cheap stock.

And it shouldn’t really surprise anyone that the stock eased a bit after breaking through $2,000 a share in early September. The stock crossed the $1,000 mark less a year earlier. You can’t underestimate gravity.

Even with its recent decline, the stock is still showing a gain of 427% since the start of 2015. Anyone who is a long term holder of this stock is not complaining. I am pretty sure about that.

And I hate to break it to those who focus on Amazon’s lack of earnings and enormous PE. To state the obvious, this is not the basis upon which investors are valuing Amazon stock. If it was, then it would never trade this high in the first place.

What Amazon does have in spades is growth – consistent growth and growth from a large base – and a large addressable market. And whether you want to express that in a explicit valuation metric or not, this is the basis upon which people are long the stock.

First, let’s look at Amazon’s growth record. I was wondering today just how consistently Amazon grows its sales so I took a look at the company’s investor relations page. The page has four years of quarterly earnings conveniently displayed.

You may or may not be surprised to learn that Amazon has grown its revenues in every single one of those 16 quarters and the year-on-year growth rates ranged from 15% to 43% in those quarters and averaged nearly 28% over that period.

Note that at times when it seemed Amazon’s growth rate was slowing in percentage terms, it was able to come back and report faster growth in later quarters.

Obviously, this unbroken run of growth means that Amazon has only got bigger and bigger. The law of large numbers alone should be making it harder and harder to keep up these 20% growth rates.

I would hazard to guess there are not many companies in corporate history that have grown that fast at that size with such consistency, though of course Google (I haven’t done the numbers) probably doesn’t look too bad either given the gold mine that is search and Microsoft seems to have turned over a new leaf in recent years.

The difference between Amazon and Google/Alphabet, however, is the size of their addressable markets. Google is mainly attacking the advertising market. According to one report I found on the internet, annual advertising spending globally is $500bn-plus.

Amazon is disrupting retail (and web services and a few other things – including advertising too – but let’s not overcomplicate it).

Now there is a lot more to retail than the goods that Amazon sells and there will be corners of retail not even it will ever reach, but this is a $20trn-plus market, that is, many times bigger than the advertising pie. Within that, retail e-commerce is a $5trn market but one that is obviously going to grow faster than retail overall.

The sheer size of that opportunity, still, is another reason why Amazon trades where it does and Google trades at 27 times.

I am not saying Amazon won’t stumble or can’t go lower here. Like all large companies, it’s inevitable that it will have some troubles at some point.

But not all of its growth is organic and it is able to acquire selectively from a position of strength. The purchase of Whole Foods Market last year has clearly bolstered the top-line.

The price action in recent months show it won’t take much bad news to put a dent in the stock, but neither should it when the stock has risen so fast so quickly. And if Jeff Bezos was ever to get run over by a bus, it would obviously not be pretty.

But Amazon’s demise has been predicted many times before and there are good reasons why those predictions have been wrong. One is that customers love the business because it has customer-centric approach that puts so many incumbent companies to shame.

My point is it is getting old to go on and on about Amazon’s PE. Get back to us when this company stops innovating and stops growing its top line but I suspect that won’t be for a while yet, and if it looks like happening this company can buy some growth too.

I don’t own the stock but did at $180.00 (when was that?) and sold at $200.00 after reading one too many articles on Seeking Alpha about how overvalued it was. And I regret it to this day.

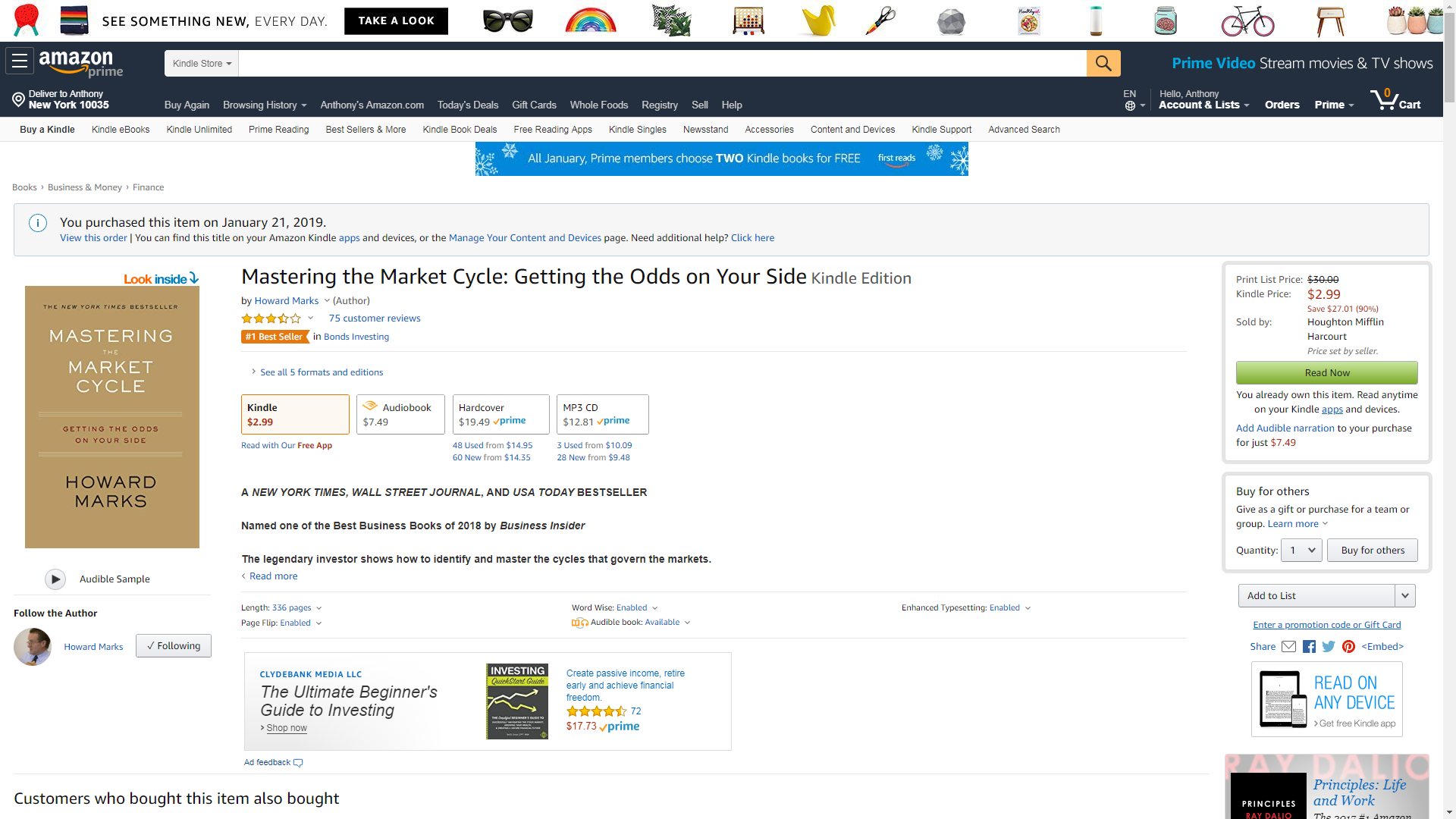

Howard Marks book deal on Amazon today: Take a look (I bought it)

Can’t speak for this one but his last book was great!

Try the link here.

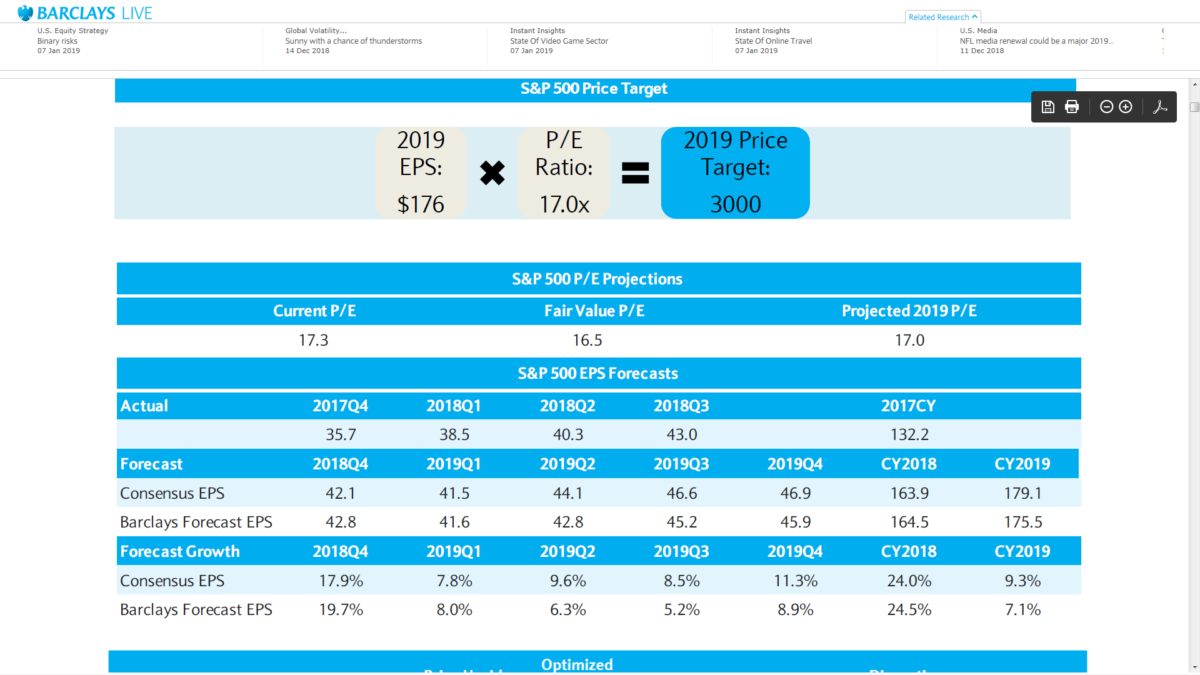

Barclays: S&P 500 at 3000 (exactly) at year-end

Equity strategists see S&P 500 up 9.5% to 3000 by year-end: so precise?

A little taste of John Bogle wisdom

Some quotes from Bogle’s book Enough

The passing of Vanguard founder and index fund pioneer John Bogle was rightly big news in finance this week. Truly selfless individuals are hard to find in any walk of life, let alone Wall Street, but Bogle probably did more than anyone to lower costs for small investors and champion investor rights, and he was someone with a strong moral compass about the bad things that often happen on Wall Street.

Last year I read one of his many books –

Enough: True Measures of Money, Business, and Life and, like all the books I read, highlighted some passages that resonated with me. Here they are:

“Some men wrest a living from nature and with their hands; this is called work. Some men wrest a living from those who wrest a living from nature and with their hands; this is called trade. Some men wrest a living from those who wrest a living from those who wrest a living from nature and with their hands; this is called finance.”

“Innovation in finance is designed largely to benefit those who create the complex new products, rather than those who own them.”

“Above all, remember (again, courtesy of Warren Buffett), ‘What the wise man does in the beginning, the fool does in the end.’ Or, as the Oracle of Omaha sometimes expresses it, ‘There are three i’s in every cycle: first the innovator, then the imitator, and finally the idiot.’ No matter what fund managers may offer you, don’t you be the idiot.”

“My faith in trust goes back to the Golden Rule. We are, after all, implored in the Bible to love our neighbors, not to quantify their character; and to do unto them as we would have them do unto us, not to do unto them in exact equal measure what they have done to us.”

“Returning professional conduct to a more important role in business affairs will be no easy task. One avenue to pursue, curiously enough, was suggested by a mailing that arrived on my desk with a typographical error that I just couldn’t ignore. Sent out by the Center for Corporate Excellence to announce that General Electric would receive its Long-Term Excellence in Corporate Governance award, the flyer quoted GE president Jeffrey Immelt on the importance of ‘sound principals of corporate governance.’ Clearly, the quotation should have read principles, not principals.”

“We are now seeing in our corporations and our financial markets the result of the triumph of business standards over professional standards—far too much of the former, not nearly enough of the latter.”

“As René Descartes reminded us four full centuries ago, ‘A man is incapable of comprehending any argument that interferes with his revenue.'”

Er, US government shuts down for four weeks, DJIA rallies for four weeks

Dow Jones Industrial Average up four weeks in a row

| Closing price | Points move | % move | |

| This Week | 24,626.53 | +630.58 | +2.63% |

| 11-Jan-2019 | 23,995.95 | +562.79 | +2.40% |

| 4-Jan-2018 | 23,433.16 | +370.76 | +1.61% |

| 28-Dec-2018 | 23,062.40 | +617.03 | +2.75% |

| 21-Dec-2018 | 22,445.37 | -1,655.14 | -6.87% |

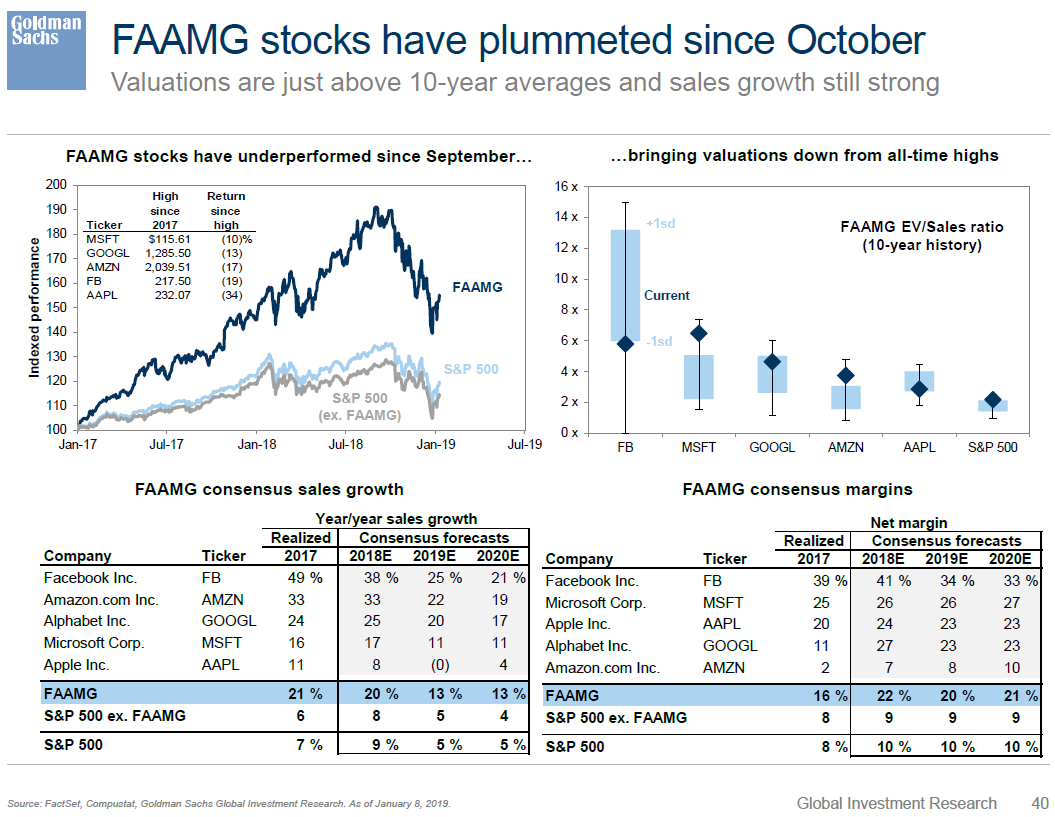

Some interesting charts from latest Goldman research: FAAMG stocks

Valuations are still high but these remain growth companies…and the companies that many think/fear will dominate the future

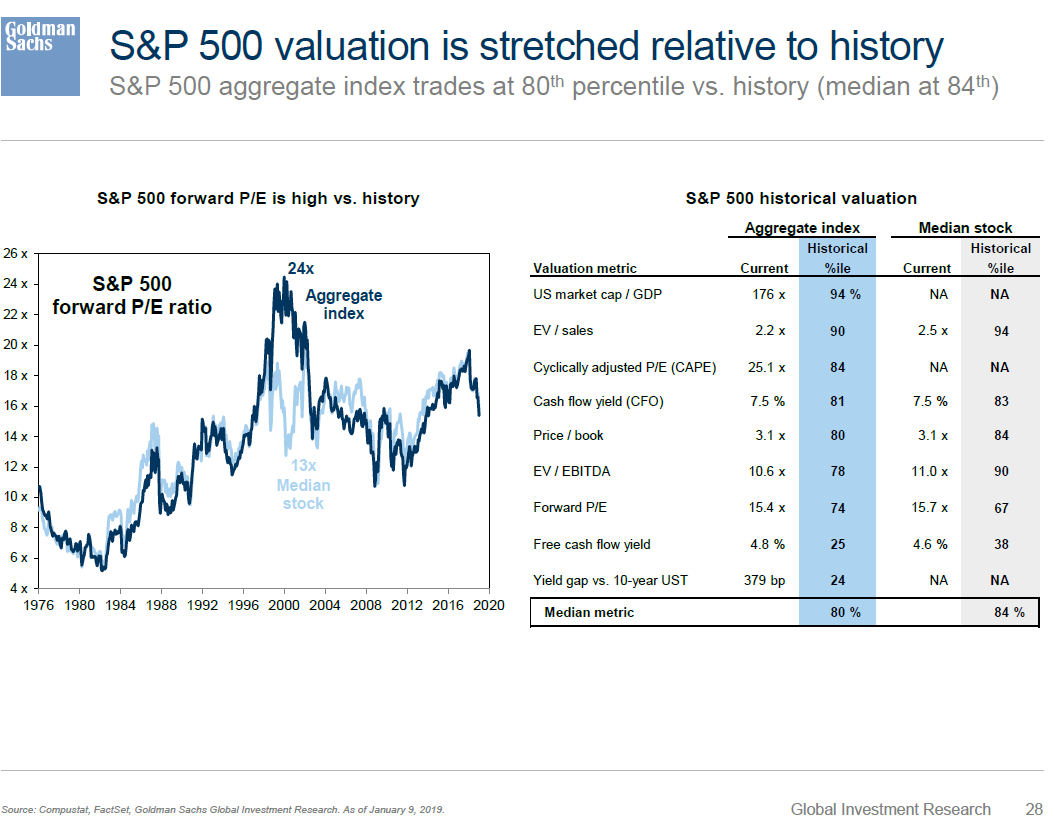

…but stocks generally still look expensive on a variety of metrics.

Global stock indices year-to-date: Argentina, Brazil leading charge

Chart showing year-to-date returns for major global stock indices, including major country indices (zoom in if necessary). Happily, there’s a lot of green right now, but will it last?

Source: Refinitiv/Eikon

2016 redux?

One bullish take on what could be next after S&P’s 10% rally since Xmas eve

One trader I talked to this week said no one believes it, but it is rare for the stocks to bounce back as rapidly as they have since Christmas Eve (S&P 500 up 10%). The above post puts some data around that.