Not much. A few people have been asking me what impact the government shutdown has on the US IPO market and ECM activity generally as it restarts in 2019.

The basic answer is that no IPO is able to price until the shutdown is over, though with financial markets so choppy, it is kind of a moot point anyway.

Since late last month, the Securities and Exchange Commission has been operating with a skeleton staff. The corporate watchdog has already told issuers and their advisers it won’t be able to declare their registration statements “effective”.

This includes the S-1 statements that IPO aspirants have to file before they can raise cash from investors.

What does that mean? Effectiveness is one of the final steps before a company goes public under US securities regulations, which require new securities to be registered with the SEC.

So without the ability to get effective, companies can’t go public.

Of course, an issuer could launch an IPO in the hope that by the time its investor roadshow ends (usually seven or eight business days) the shutdown will be over. And there’s been some talk about ways to sidestep the SEC, but they are not practical, at least for mainstream IPOs.

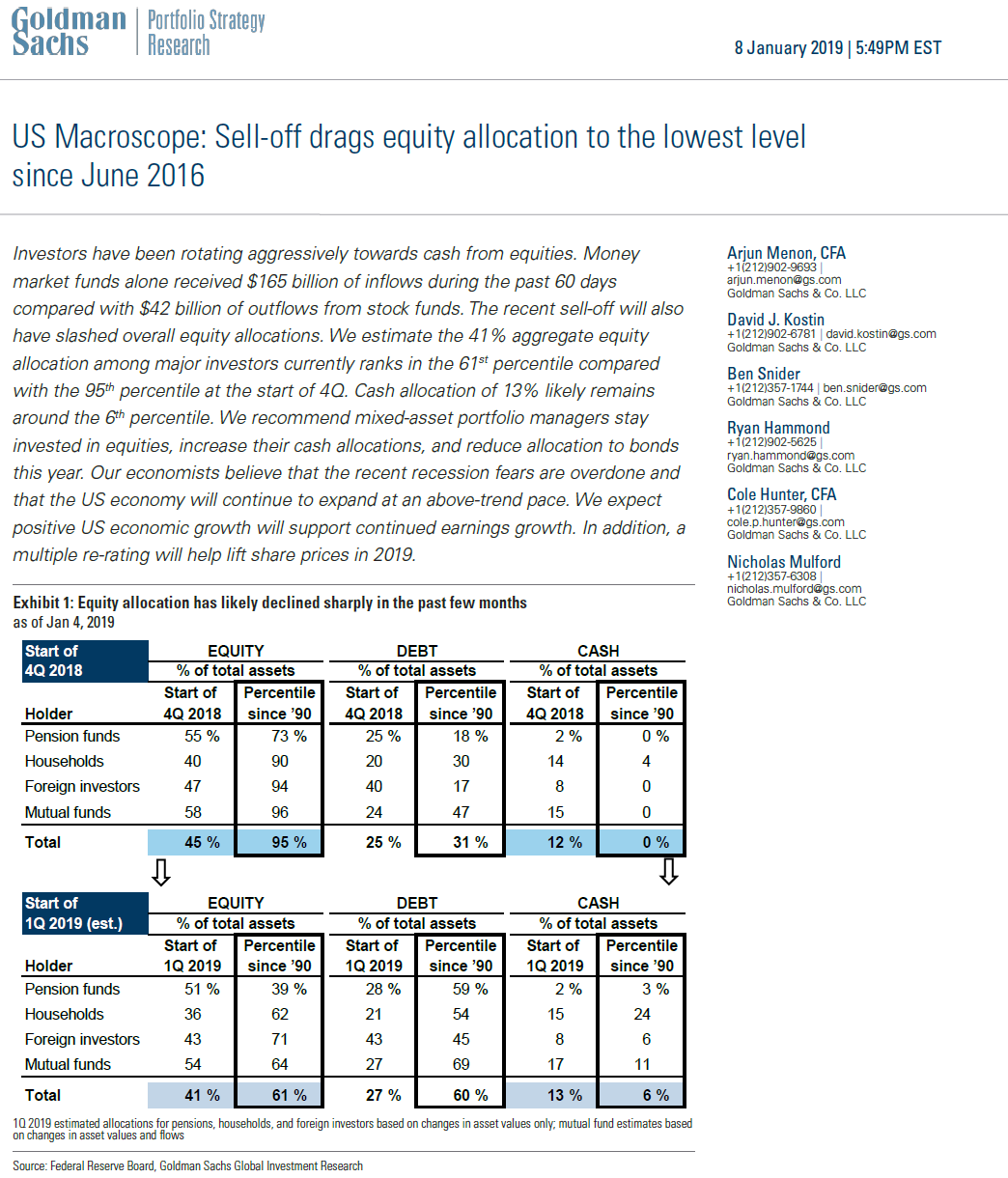

The talk among bankers is that, notwithstanding Friday’s impressive up move in stocks, no one really wants to go first here until market conditions stabilize properly.

You never know, maybe that happens now that the Fed and the market are on the same page (maybe?).

Based on recent filings and taking into account deals that were delayed in the final months of 2018, there were maybe 10 or more companies that would have tried to go in January absent the shutdown.

A lot of these would have been biotechs and China-to-US deals that have big insider backing, de-risking their fundraising and making somewhat insensitive to market conditions.

Hard to say when this shutdown ends (no progress today) but until then the IPO market is on ice.

As for follow-ons, well-known seasoned issuers and companies with existing shelf registrations can price stock offerings, but it doesn’t sound like it will be a flood.

That said, with Friday’s surge maybe some investors that have managed to put 2018 behind them and are now sniffing better times ahead will be prepared to put new money to work.