Recent surveys suggest as many as three in four economists believe the US will go into a recession by 2021. Maybe they are right. I don’t know about 2021 (and they don’t really either) but as night follows day, there will be a downturn eventually.

To me, the bigger question is this: How deep the next downturn will be?

Now I am not really going to answer that question but I think this is what people should consider before they buy into doom-and-gloom prognostications.

There hasn’t been a US recession since 2007-2008, which means forecasting one in the next year or two is almost like insurance for a professional forecaster. Forecasts are mostly wrong too but that doesn’t stop people from making them.

In fact, countries can go for very long periods without a recession (Australia, for instance, hasn’t had one since the early 1990s).

Next year’s US Presidential election also means there is a huge political dimension to the economic commentary that appears in the press, and one should be especially wary of any politician trying to pass themselves off as an economist.

A recession is arguably the only event that assures Donald Trump will lose. His opponents know that when they discuss the economy.

I think it is possible that the next recession could well be more of the “statistical” variety and quite shallow.

For one thing, economic activity in the past year or so has been juiced by the 2018 corporate tax cuts (people seem to forget about them).

Greater corporate earnings flow through to the economy in a variety in different ways and quite quickly too (one reason why governments prefer tax cuts to spending on big projects when trying to quickly stimulate the economy).

If the growth numbers were in any way exaggerated in the past year, which seems entirely possible, then it is simply a mathematical reality it is going to be harder to grow at the same rate and better those conditions a year or two hence.

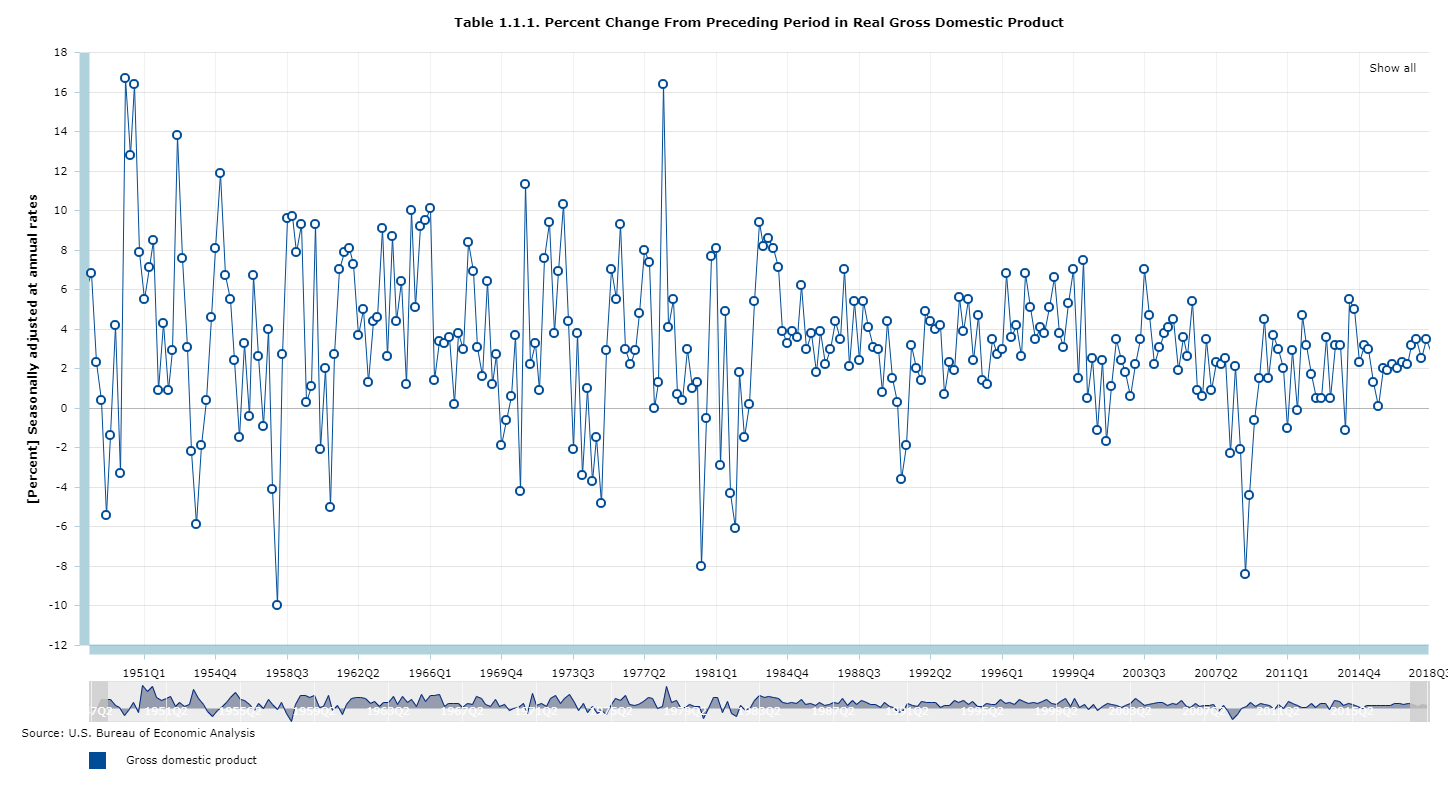

Real GDP grew 2% year-on-year in the second quarter of 2019, but you can see on a long-term chart (below) GDP growth has flattened over time as the economy has got bigger and bigger save for large blips like 2007-2008.

Growth is harder to come by when you are already the biggest economy in the world (a $20trn economy), so let’s not pretend it is easy to do so.

A recession also means different things to different people.

Here’s an article from the New York Times published in December last year:

“Some say (a recession) happens when the value of goods and services produced in a country, known as the gross domestic product, declines for two consecutive quarters, or half a year.

“In the United States, though, the National Bureau of Economic Research, a century-old nonprofit widely considered the arbiter of recessions and expansions, takes a broader view.

“According to the bureau, a recession is ‘a significant decline in economic activity’ that is widespread and lasts several months. Typically, that means not only shrinking GDP, but declining incomes, employment, industrial production and retail sales, too.”

All true, but you might also say that a recession means different things to different people, in that during this period one person can lose their job and come under financial duress, and another can be completely unaffected (if they have a steady job in a good industry). What I am trying to say is that the numbers in themselves don’t matter as much as how a recession actually affects people’s lives.

A deep recession would mean a spike in unemployment, which is really the key statistic.

Yet the data continue to show US job growth.

The chart below shows US unemployment (3.7%) is at its lowest level since the 1960s. Is a big spike in unemployment around the corner? Are these numbers even relevant any more?

The gig economy seems to be changing the definition of work and driving down the unemployment rate with lowly paid jobs. This may also mean unemployment doesn’t rise sharply in a downturn like it might have done in the past (as everyone picks up gig jobs if they have to).

Though some are talking about another credit crunch, there is no doubt the economy and companies are cushioned by low interest rates, in turn facilitated by low inflation.

By the way, that is another thing many economists have got wrong in the past decade. They expected inflation to break out because of the Fed’s rampant money printing, but funnily enough, it never happened and the Fed has had no choice but to keep rates low to try to ward off outright deflation.

The Fed is likely to cut rates later this month for the second consecutive meeting, somewhat reluctantly and unusually all while the economy and jobs are still growing.

The politics can’t be discounted here either, by which I mean the Trump Administration has much riding on there being no recession in the next year at least. This is why Trump is riding Fed chair Jerome Powell to cut rates and holding out the prospect of more tax cuts.

There is always a risk of a large downturn and the US economy has problems that stem from too much consumer and government debt and high healthcare costs, but my point is that pays to keep things in perspective.