Try the link here.

Essential thoughts on US stocks, financial markets, M&A and IPOs…and some other random topics

Can’t speak for this one but his last book was great!

Try the link here.

Equity strategists see S&P 500 up 9.5% to 3000 by year-end: so precise?

Some quotes from Bogle’s book Enough

The passing of Vanguard founder and index fund pioneer John Bogle was rightly big news in finance this week. Truly selfless individuals are hard to find in any walk of life, let alone Wall Street, but Bogle probably did more than anyone to lower costs for small investors and champion investor rights, and he was someone with a strong moral compass about the bad things that often happen on Wall Street.

Last year I read one of his many books –

Enough: True Measures of Money, Business, and Life and, like all the books I read, highlighted some passages that resonated with me. Here they are:

“Some men wrest a living from nature and with their hands; this is called work. Some men wrest a living from those who wrest a living from nature and with their hands; this is called trade. Some men wrest a living from those who wrest a living from those who wrest a living from nature and with their hands; this is called finance.”

“Innovation in finance is designed largely to benefit those who create the complex new products, rather than those who own them.”

“Above all, remember (again, courtesy of Warren Buffett), ‘What the wise man does in the beginning, the fool does in the end.’ Or, as the Oracle of Omaha sometimes expresses it, ‘There are three i’s in every cycle: first the innovator, then the imitator, and finally the idiot.’ No matter what fund managers may offer you, don’t you be the idiot.”

“My faith in trust goes back to the Golden Rule. We are, after all, implored in the Bible to love our neighbors, not to quantify their character; and to do unto them as we would have them do unto us, not to do unto them in exact equal measure what they have done to us.”

“Returning professional conduct to a more important role in business affairs will be no easy task. One avenue to pursue, curiously enough, was suggested by a mailing that arrived on my desk with a typographical error that I just couldn’t ignore. Sent out by the Center for Corporate Excellence to announce that General Electric would receive its Long-Term Excellence in Corporate Governance award, the flyer quoted GE president Jeffrey Immelt on the importance of ‘sound principals of corporate governance.’ Clearly, the quotation should have read principles, not principals.”

“We are now seeing in our corporations and our financial markets the result of the triumph of business standards over professional standards—far too much of the former, not nearly enough of the latter.”

“As René Descartes reminded us four full centuries ago, ‘A man is incapable of comprehending any argument that interferes with his revenue.'”

Dow Jones Industrial Average up four weeks in a row

| Closing price | Points move | % move | |

| This Week | 24,626.53 | +630.58 | +2.63% |

| 11-Jan-2019 | 23,995.95 | +562.79 | +2.40% |

| 4-Jan-2018 | 23,433.16 | +370.76 | +1.61% |

| 28-Dec-2018 | 23,062.40 | +617.03 | +2.75% |

| 21-Dec-2018 | 22,445.37 | -1,655.14 | -6.87% |

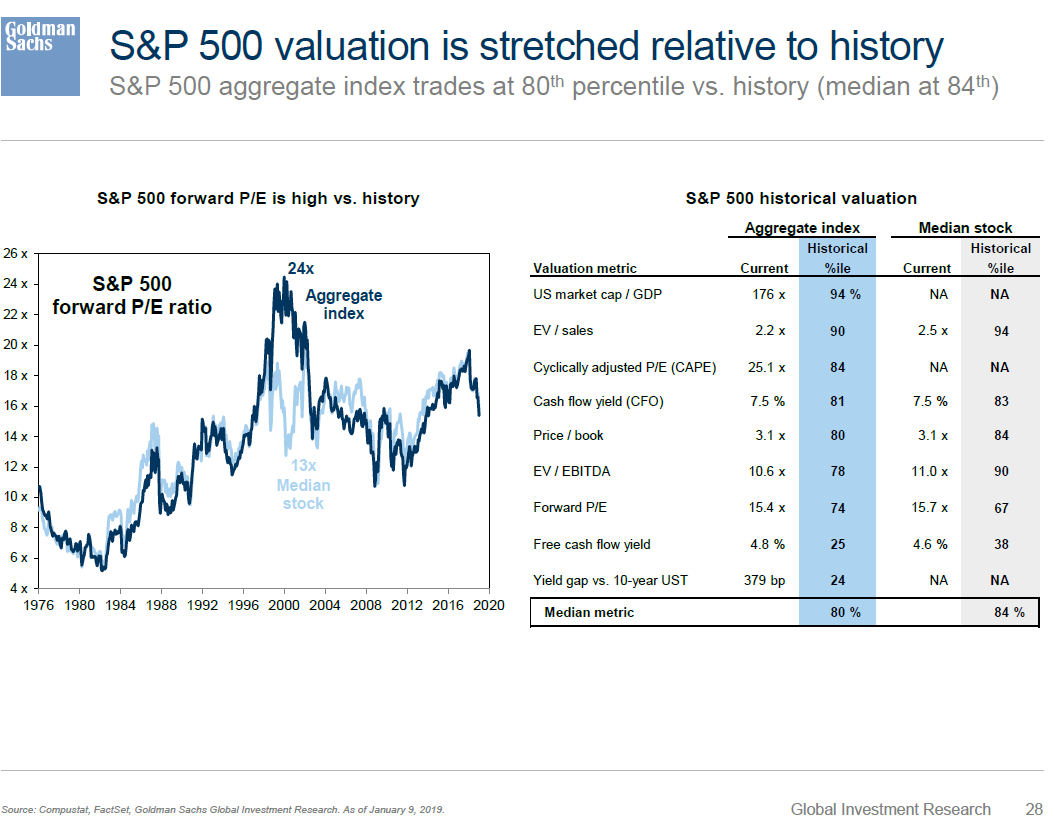

Valuations are still high but these remain growth companies…and the companies that many think/fear will dominate the future

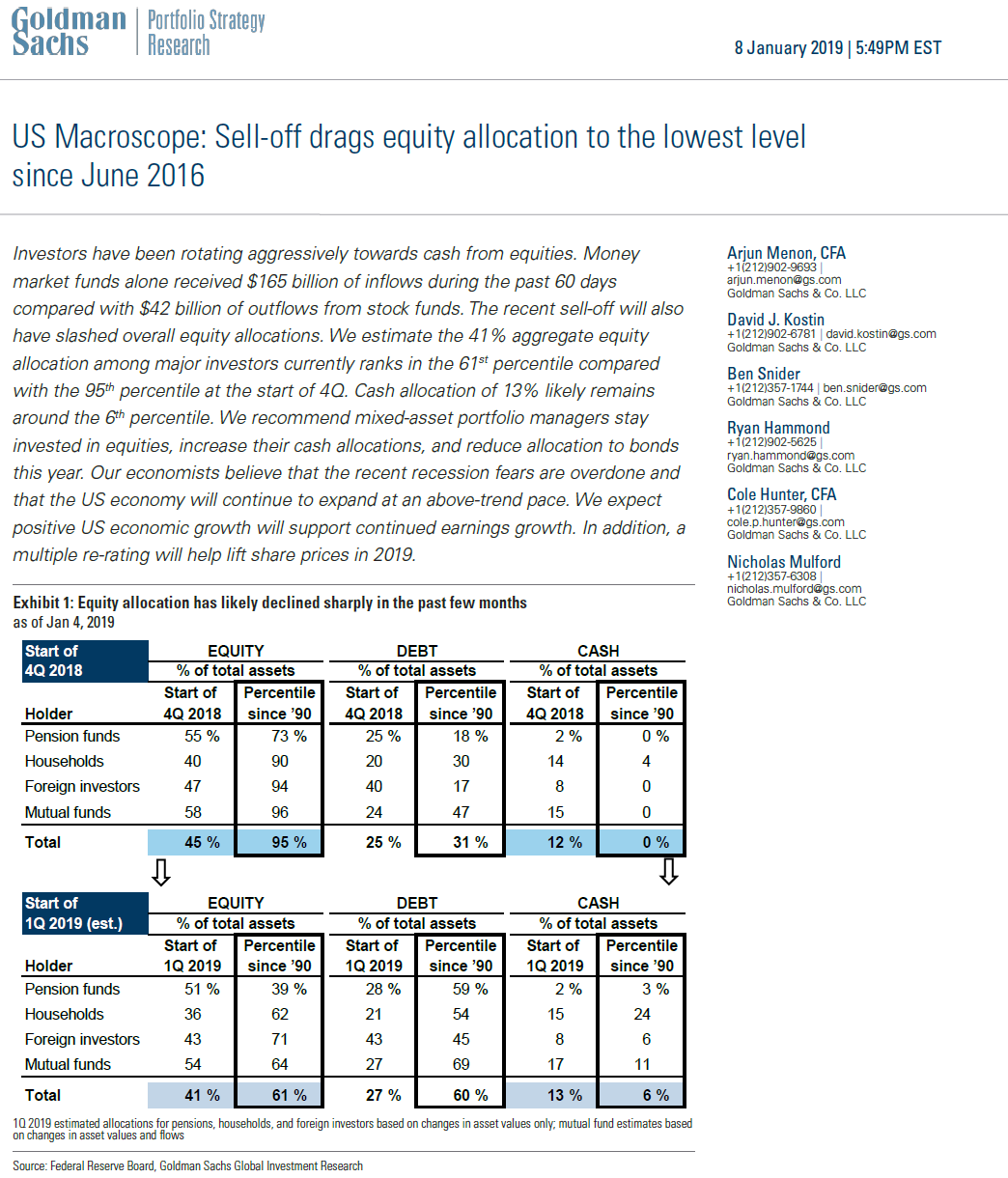

…but stocks generally still look expensive on a variety of metrics.

Chart showing year-to-date returns for major global stock indices, including major country indices (zoom in if necessary). Happily, there’s a lot of green right now, but will it last?

Source: Refinitiv/Eikon

One trader I talked to this week said no one believes it, but it is rare for the stocks to bounce back as rapidly as they have since Christmas Eve (S&P 500 up 10%). The above post puts some data around that.