DJIA constituent returns (column 4 for 2018 full year returns)

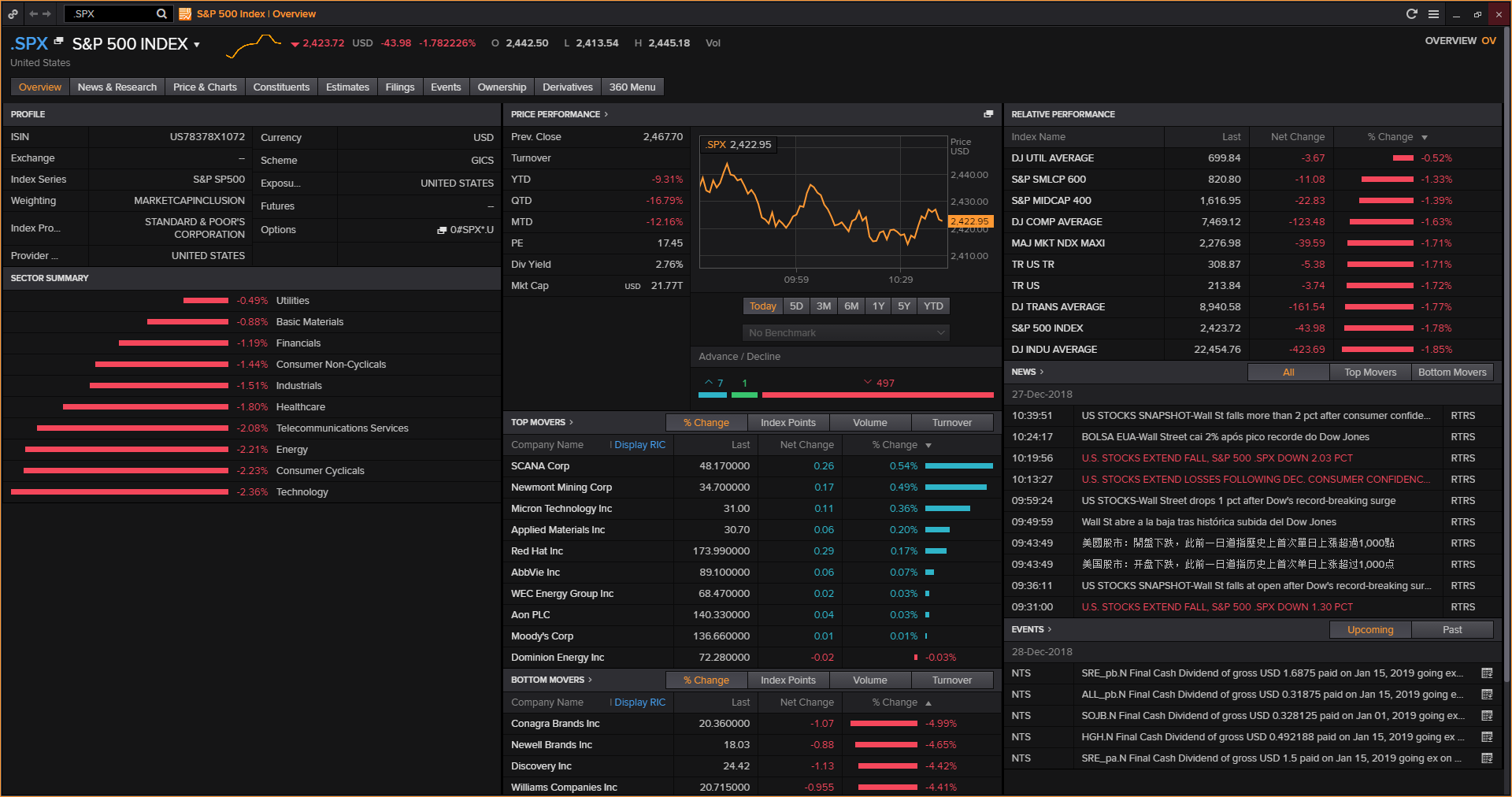

Source: Refinitiv/Eikon

Essential thoughts on US stocks, financial markets, M&A and IPOs…and some other random topics

DJIA constituent returns (column 4 for 2018 full year returns)

Source: Refinitiv/Eikon

Welcome to my new blog.

I am still working all this out, so bear with me as I refine this site. This is kind of a test, though I also couldn’t resist posting a little something today in light of the extraordinary market rally.

The DJIA surged 1,086.25 points or 4.98%, stunning the growing sleuth (sloth?) of bears.

More than a few of those bears are the same people that (rightly or wrongly) have the pitchforks out for our/your President, which I think really speaks to how the current obsession with news flow out of Washington is clouding a sober assessment of financial markets.

On the other hand, the blue-chip index is still down 7.5% this year, 13.5% this quarter and 10.4% this month (we’ll try to spare you too many numbers).

Obviously today’s bounce happened in a holiday week and came alongside an 8.7% rebound in oil prices (commodities=volatility). So it is hard to be too confident it will hold.

Maybe stocks will go back down tomorrow, but Monday’s 650-point fall was probably over-amplified as well in a week in which there is little market-moving corporate or economic news.

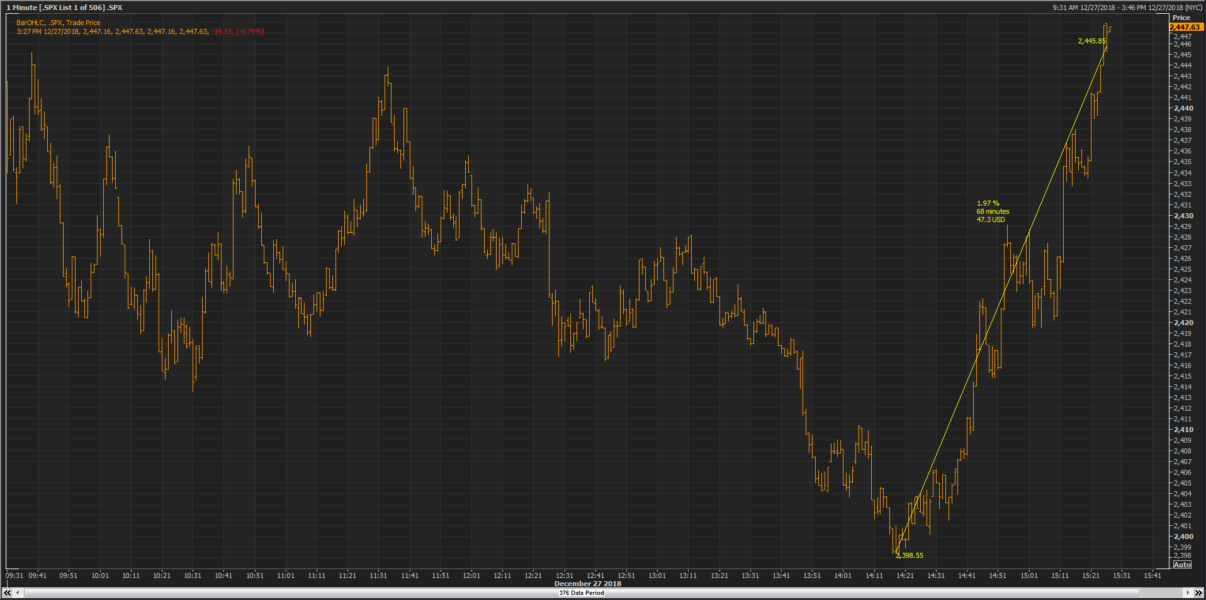

In fact, as the chart here shows, we haven’t seen a similar daily percentage movement in the market since the 2008/2009 period when financial markets fully collapsed (and markets gyrated wildly).

Yet Twitter alarmists aside, I just don’t think anyone is seriously arguing today’s market and economic environment is anywhere near as bad as that.

So is this the bottom? Are investors just trying to second guess an inevitable January rebound? All possible, but no one, of course, really knows.

Not many talking heads have explained well what is going on but I thought journalist James Stewart (author of the great books Disney Wars and Den of Thieves) nailed it pretty well this morning on CNBC.

He dismissed a lot of the political headlines as noise and attributed the recent correction to stocks having simply been over-valued going into an earnings slowdown next year.

He’s right that valuations and earnings are the two issues to really focus on.

You can fret if you like about stocks falling 15% but they were due a breather after a 300%-plus rally since the generational low in March 2009. Call it gravity if you like.

And taking nothing away from Amazon and Netflix as two of the best companies out there (I am a happy customer of both), they were at the vanguard of this rally as part of the FAANGs and it was inevitable their stock prices would have to ease off at some point.

Going into the final months of this year, I actually felt the biggest risk to the market was that Amazon would put out some bad news (earnings miss etcetera) that would chop $500 a share from its price and bring the rest of the market with it.

There wasn’t really much bad news out of Amazon itself but the stock did fall by more than that as investors just got skittish about tech valuations. Along with the slump in oil prices, this is the most tangible reason behind the market declines we have seen.

As for the China trade war issue, it obviously concerns a lot of people but it is hard to quantify.

In fact, I have noticed that any headline issue that can’t be easily quantified but weighs on stocks often throws up a buy-the-dip opportunity.

On the earnings front, people forget that this year’s extraordinary 20%-plus rise in earnings per share (Q3 earning per share for S&P 500 companies rose an average of 28% according to Refinitiv) was goosed by tax cuts.

So when all these companies report their Q1 2019 numbers (not until April-May), they will be cycling tough comps and probably reporting sub-10% EPS growth. In fact, Refinitiv has S&P 500 earnings growing just 5.5% in Q1 2019 and 6.7% in Q2 2019.

I think a lot of the recent decline is investors adjusting for that reality.

But much of that decline in growth is just math, not some seismic change in corporate profitability or the economy.

We also have in President Trump a “Financial Advisor-in-Chief” who spends an inordinate amount of time (for a property guy) watching stocks and talking up the market via his favored social media platform.

Add in a more dovish Fed, which I think you can still count as a friend of investors (though it didn’t seem so last week), and you could easily see today’s move as the start of a process of healing the market damage of the past quarter.

What do you think?